Telco research specialists, STL Partners, conducted a survey with industry executives in which they asked respondents to rank five digital BSS use cases for the enterprise market in terms of the impact they felt each use case would have on their business’s bottom line. The five use cases were:

- Real-time billing management

- Automated service configuration and purchasing

- Partner/wholesaler management

- Customer analytics

- Zero-touch end-user account management

These use cases were selected as they provide solutions to the challenges most commonly faced by operators serving the B2B market, including an inability to serve SMEs effectively, complicated processes for on-boarding new partners, and difficulty providing financial controllers and resellers with real-time control over usage and costs, without negatively impacting workplace productivity.

The majority of respondents (60%) ranked real-time billing in first place. This is unsurprising as it is well-known that this use case cuts the requirement for customer services dramatically, whilst also reducing churn. In second place, respondents ranked automated service configuration and purchasing, followed by zero-touch end-user account management in third place. In joint fourth place were customer analytics and partner/wholesaler management (see Figure 1 below):

Fig 1 - Real-time billing management is perceived as having the most significant impact on telco business

STL Partners then compared these results with their own modelling, based on the potential benefits derived from each digital BSS use case for a theoretical mobile operator. Interestingly, STL Partners’ own modelling found that it is actually automated service configuration and purchasing that would have the biggest impact on telco bottom lines, and not real-time billing management, as respondents believed.

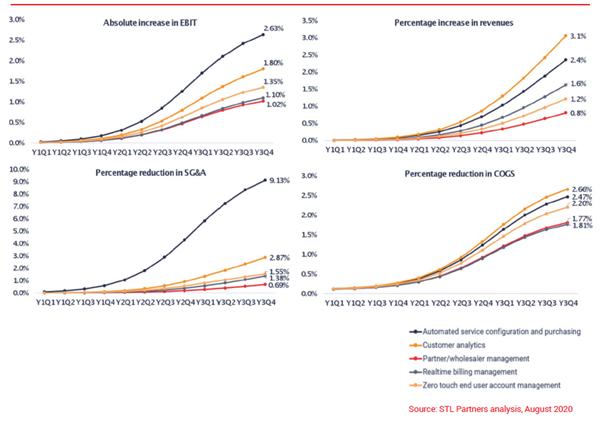

Automated service configuration, which enables customers to tailor solutions to meet their exact requirements, is essential for operators looking to serve the SME market more efficiently. The improved customer journey and streamlined processes would reduce selling, general and administrative expenses (SG&A) by a massive 9.1%, and the cost of goods sold (COGS) by almost 2.5%, whilst increasing revenues by 2.4%. This would result in an overall increase in EBIT of 2.6%, as Figure 2 indicates:

Fig 2: Automated service configuration and purchasing will have the most significant impact on bottom line

Implementing customer analytics would also have a notable impact on EBIT – 1.8% to be precise – due to the increased revenues and reduced costs this use case would deliver for operators acting on their newfound insight into churn indicators and cross and upsell opportunities.

Real-time billing management – which respondents believed would have the biggest impact on their bottom lines - would result in a 1.1% increase in EBIT, putting it in fourth place, behind zero-touch end-user account management (1.4%) and ahead of partner/wholesaler management (1.0%).

Whilst each use case has a different impact on key operational metrics, and is of course crucial for ensuring a seamless customer experience, the number one priority for operators looking to increase EBIT should be automated service configuration.

Of course, operators will reap the biggest rewards if they implement all five use cases quickly and in parallel. In fact, STL Partners’ modelling found that operators who successfully implement all five use cases could increase their EBIT by 3.4% over three years. For an operator with an historic EBIT of 10%, this would equate to a 34% overall improvement in EBIT.