If you’re new to telecoms, your head is probably spinning with all the jargon. Ours is a highly fragmented business, with lots of different layers playing their part. And each has its own terminology. So what is an MVNO? Read our complete MVNO definition.

Definition

A Mobile Virtual Network Operator, or MVNO to use the acronym, is essentially a reseller of mobile telecommunications services.

At its most basic, the heavy-lifting part of running a mobile business is creating a network infrastructure – putting radio transmitters up and down the country. In the 1980s and 1990s, the pioneers like BT and Vodafone spent billions on this infrastructure; and they’ve done very well out of it.

At its most basic, the heavy-lifting part of running a mobile business is creating a network infrastructure – putting radio transmitters up and down the country. In the 1980s and 1990s, the pioneers like BT and Vodafone spent billions on this infrastructure; and they’ve done very well out of it.

But there is plenty of spare capacity on those towers, and so there is profit to be made by both these infrastructure owners and people who are good at marketing or other aspects of telecoms delivery, in renting bandwidth and attracting new audiences to use it.

In a typical relationship, then, the service provider leases capacity (minutes, texts and megabytes) from a third-party mobile network operator (MNO), who owns the infrastructure. A wholesale agreement determines the price paid by the operator for that capacity, and the operator is then free to create its own business model to turn a profit. Smart operators create innovative bundles, packages and marketing activities which dress up their raw capacity purchase in ways which appeal to their niche or target audiences.

Now that data, rather than calls, has become a prized commodity, this has opened up even more interesting and flexible ways for MVNOs to appeal to their audiences. We’ll look at that shortly, but first…

A history lesson

The world’s first MVNO was Virgin Mobile, launching to the UK market in November 1999 – yes, the MVNO is barely a teenager. Virgin’s launch was the culmination of a set of circumstances going back almost a decade: the European telecoms market had been liberalised in regulatory terms and, most importantly, the technology had become good enough that there was room for product differentiation. By the mid 1990s, mobile was becoming popular – a consumer commodity rather than the high-end executive’s companion of the late 1980s, and that meant there was room for multiple brands to establish their identities.

the European telecoms market had been liberalised in regulatory terms and, most importantly, the technology had become good enough that there was room for product differentiation. By the mid 1990s, mobile was becoming popular – a consumer commodity rather than the high-end executive’s companion of the late 1980s, and that meant there was room for multiple brands to establish their identities.

Just as importantly, regulators were dealing with a challenge. This huge demand for mobile was outstripping the limited frequency bands allocated to wireless services, and after some seminal court challenges (e.g. Sense Communications in Scandinavia), regulators stepped in to unlock the bottleneck. They saw the potential of the business model to extend the reach of mobile services without the need to allocate new frequencies. Legislation was passed which required network operators deemed to have “Significant Market Power” (often traditional national telecoms carriers) to open up their infrastructure to third parties.

This was, of course, long before 4G or even 3G. There were no data plans. WAP over GSM was the pinnacle of mobile connectivity. It is impossible to overstate the importance of differentiation in mobile, and in these early days, the only true differentiator was price. Things have changed enormously since.

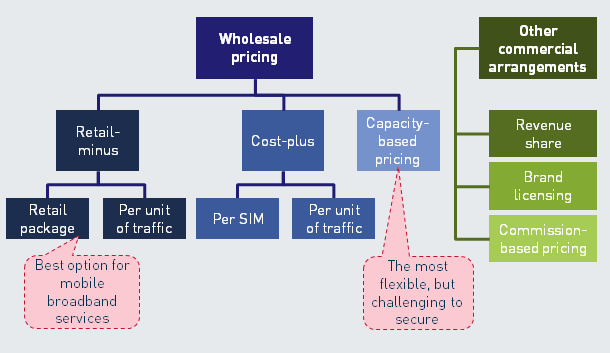

How are wholesale agreements created?

The first step to becoming an MVNO is negotiating a contract with the operator – the wholesale agreement. There are dozens of possibilities and permutations but two basic models are as follows:

In Cost Plus, a reasonable wholesale cost for each product (minutes, texts and, data) is established, and a margin is added. The starting point might be a regulated wholesale rate, where applicable, or the Mobile Termination Rate (MTR); however this is usually commercially driven. The challenge with cost plus lies in the rapid changes in pricing – the cost of data has declined by more than 80% in the UK between 1Q 2010 and 2Q 2014, with similar trends across Europe[1].

The most straightforward approach is a Retail Minus model, where a retail price for each product in the market is established, using various methodologies e.g. by setting a retail price index, and then reducing the retail price to a wholesale cost by an appropriate margin (typically 15 - 30%). This can even include ‘unlimited’ bundles for texts and voice, a common practice even for MVNOs. In this way, any risk associated with high usage of the bundle is carried by the operator, not the MVNO.

Summary of MVNO pricing structures [Source: Analysys Mason, 2015]

Summary of MVNO pricing structures [Source: Analysys Mason, 2015]

The model that suits best will be determined partially by the depth and complexity of services the provider wishes to operate. There is, naturally, a set of terms for how deep an MVNO wants to go…

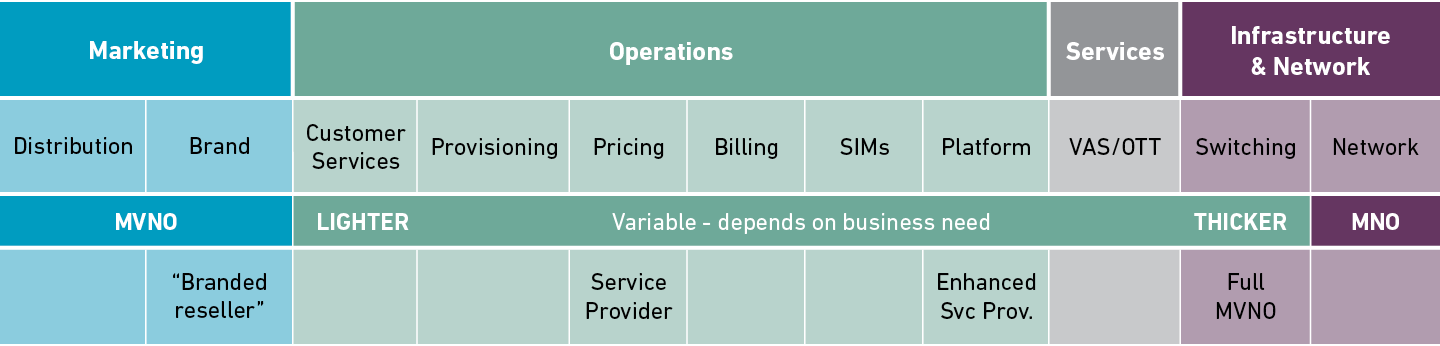

Operations: Thick vs Light

We saw earlier that the landscape is defined by MNOs who run wires and towers around the country, and the MVNO who handles marketing. But the functional operations of a mobile business are a little more complex, and when we get to a more granular level, there is room for the MVNO to take much more, or much less, operational responsibility.

Which of these is the case is, of course, a business decision to make. Here is a typical list of functional activities in a mobile business; as you can see, between the network and the customer-facing sales operation are a whole raft of operations which may or may not be conducted by the MVNO:

As providers become data-rich businesses in their own right, rather than the marketing hybrids of the 1990s, the question of whether to piggyback on the Operator’s resources becomes less an issue of convenience and available resources and more one of commercial advantage. An operator which owns its own pricing and billing infrastructure has far greater freedom to build attractive products – and change them in real-time. And by owning its pricing and billing destiny, it can be more responsive, agile and therefore profitable.

A good example of the variability of MVNO structures is the Customer Services function. Network operators all have their own customer service functions for their own customers, so it’s an easy ‘off the shelf’ option for them to offer their MVNO clients some call-centre space. On the other hand, a retail MVNO may already have a call centre too – one which is staffed by people who already know and love the brand and its products.

Because MVNOs are effectively defined by their lack of spectrum licenses, they necessarily will need to have agreements in place to access the network of at least one MNO (the yellow box on the right of our diagram). After that, however, there is plenty of variability; and the terms that have emerged are “thick” for MVNOs which nudge rightwards on our diagram, fulfilling more of the operational functions, and “thin” or “light” for those which stay to the left of our diagram, providing only a thin marketing layer over the bulk of the traditional operator’s activities. Here are some typical deployments:

- Branded reseller: The branded reseller relies almost completely on the MNOs facilities. They may own and operate their own customer care, marketing, and sales operations. These are the easiest arrangements to implement, but the least flexible: the operator has immense power and control over the business.

- Communication Service Provider (CSP): The classic "Light MVNO". Here, the service provider operates its own customer support, marketing, sales and distribution operations, and has the ability to set its tariffs independently from the retail prices set by the MNO. This gives the MVNO much more business flexibility, an ability to move with customer demand in the market, and a greater ability to stamp its brand over the customer experience.

- Enhanced Service Provider: We are now moving into "Thick MVNO" territory, where the MVNO manages a more complete technical implementation with its own infrastructure. This allows the MVNO more control over its offerings, and these MVNOs have a heavier focus on branding, customer-ownership, and differentiation through added services like data and SIM branding.

- Full: These MVNOs have a network implementation operating essentially the same switching technology as a mobile network operator; they are only missing the full network.

There are two further important points here.

First, the “VAS/OTT” segment is highly variable today. Originally, VAS (“value-added services”) meant voicemails and call forwarding. These were services which customers were at one stage happy to pay for, and they were also services which lived very much on the Operator’s infrastructure and systems. Today, voicemails are rarely a chargeable service, and many value-add services (for example, voice-to-text) are delivered by third parties via APIs (application programming interfaces) layered flexibly over the top of the big-box technology of an operator. Hence the term “OTT”, or “Over the top” services. The VAS segment is included where it is for historical value: today’s providers can pick and choose from a huge range of OTT services for niche differentiation; and many of them require no platform-level integration with an Operator. While Services are at the Thick end of the chart today, expect them to move ever closer to the Light...

First, the “VAS/OTT” segment is highly variable today. Originally, VAS (“value-added services”) meant voicemails and call forwarding. These were services which customers were at one stage happy to pay for, and they were also services which lived very much on the Operator’s infrastructure and systems. Today, voicemails are rarely a chargeable service, and many value-add services (for example, voice-to-text) are delivered by third parties via APIs (application programming interfaces) layered flexibly over the top of the big-box technology of an operator. Hence the term “OTT”, or “Over the top” services. The VAS segment is included where it is for historical value: today’s providers can pick and choose from a huge range of OTT services for niche differentiation; and many of them require no platform-level integration with an Operator. While Services are at the Thick end of the chart today, expect them to move ever closer to the Light...

Second – and this is again a function of maturing technology – several mobile enablement platforms allow MVNOs to punch above their technological weight and move rightwards along our diagram. The cloud and SaaS revolution has meant that individual functions (billing, provisioning, self-care, analytics) can be bought in from a provider other than the operator themselves. This again gives the MVNO plenty of flexibility to design products, and the back-office service which supports those products, with a specific customer in mind.

For an MVNO to deliver the differentiated experience that customers seek, it is imperative that they “push rightwards”, to deliver more than just a customer base and marketing function. B2B and B2C customers want a mixture of convergent services, such as broadband, fixed phone, software licenses (e.g. antivirus or business software like Salesforce.com) and/or mobile. Given that the cost of acquiring these customers is high (and getting higher as competition becomes more acute), why would a provider go to all the effort of acquiring a customer for mobile services, and then fail to market the rest of the suite? And if you’re going to offer convergent services, then it starts making sense to have proper billing (with real-time charging, selfcare and analytics to help prevent bill shock), pricing and service functions in-house. This is why the lightest MVNO business models are falling out of favour, despite being cheapest to set up.

Key players in the value chain

Mobile network operator (MNO) - has their own mobile licence, infrastructure and (usually) a direct customer relationship to the end user. The MNO can handle Network Routing and will usually have roaming deals with foreign MNOs. The MNO can produce and distribute voice minutes, messaging and data traffic themselves.

Mobile virtual network enabler (MVNE) - neither have a mobile licence nor mobile infrastructure or any direct customer relationship with the end-users. The MVNE is capable of handling Network Routing and the MVNE has typically entered into roaming deals with foreign MNOs for roaming. The MVNE is not capable of producing and distributing for example voice minutes and data traffic, but the MVNE will typically be able to handle producing SMS and MMS messages. A typical MVNE will handle customer service, customer billing, collection of consumption data and mobile handset management. Additionally the MVNE will not handle marketing and sales to end-users, this is a task for the MVNO. The MVNE functions as a middleman between the MNO and the mobile providers without their own networks. The MVNE handles the technical side and often also tasks like customer service and legal assistance for mobile providers without their own network. As a slender technology layer often without direct real-time connections to customer-facing billing systems, MNVEs have been most appropriate in off-the-shelf prepaid mobile markets. Today, the MVNE business model is being backed into a corner somewhat by demand for postpaid, highly-configurable smartphones and associated services.

Communication Service Provider (CSP) – as mentioned before, a CSP is the classic “Light MVNO” with responsibility for customer support, marketing, sales and distribution operations, and has the ability to set its tariffs independently from the retail prices set by the MNO. A CSP that has undertaken a digital transformation program will be referred to as a Digital Service Provider (DSP), a term which has become increasingly popular with the mass consumption of cellular data, combined with the growth of 4G/LTE networks. This MVNO typically offers end user services such as real time self-care, online billing, bundle add-ons or upgrades, content and apps, all sold from the end user’s device (and usually 24/7). Some more pioneering DSPs allow end users to build bespoke bundles, change how their bundle is allocated, and offer family/multi-user accounts and bundle sharing. As a consequence the prepaid/postpaid distinction which was at the heart of contract definitions is rapidly becoming not just blurred but inconsequential: DSPs show that the future of MVNOs is configurability.

Communication Service Provider (CSP) – as mentioned before, a CSP is the classic “Light MVNO” with responsibility for customer support, marketing, sales and distribution operations, and has the ability to set its tariffs independently from the retail prices set by the MNO. A CSP that has undertaken a digital transformation program will be referred to as a Digital Service Provider (DSP), a term which has become increasingly popular with the mass consumption of cellular data, combined with the growth of 4G/LTE networks. This MVNO typically offers end user services such as real time self-care, online billing, bundle add-ons or upgrades, content and apps, all sold from the end user’s device (and usually 24/7). Some more pioneering DSPs allow end users to build bespoke bundles, change how their bundle is allocated, and offer family/multi-user accounts and bundle sharing. As a consequence the prepaid/postpaid distinction which was at the heart of contract definitions is rapidly becoming not just blurred but inconsequential: DSPs show that the future of MVNOs is configurability.

The DSP isn't merely a dumb pipe offering shared access to a common utility; it's an online, real-time business that deals with countless digital/online transactions every day, managing high volumes of data traffic and multiple devices per user, and often multiple users per account. The mobile landscape has changed dramatically and CSPs are fine-tuning their businesses, and their network infrastructure, to cater for the digital needs of the data-hungry customer.

Who’s right for me? MVNO Segmentation

As the number of providers has grown (there are 1,017 MVNOs worldwide, according to GSMA Intelligence, Germany has the most of any one country with 129), invariably so has competition between providers.

And that’s not all: don’t forget that the vast majority of MNOs act as both retailers of their own mobile packages and wholesalers to MVNOs and therefore the two can compete for customers, depending on the segments they target.

So: an MVNO is in competition with other MVNOs, MNOs in the territory, and (if they’re really unlucky) their patron MNO. An undifferentiated MVNO strategy is therefore very likely to fail.

Segmentation and a clear niche are crucial. Across the world, some characteristic segments have become apparent:

- Discount: main proposition is low-cost services, e.g. GiffGaff

- Telecom: forms part of a range of telecom services such as fixed-line phone and broadband internet e.g. BT / TalkTalk

- Media/Entertainment: associated with the media or entertainment industries e.g. Virgin

- Migrant: whose primary offering is international voice services and offers deals when calling specific countries e.g. Lebara Mobile

- Retail: tied to a consumer retail brand e.g. Tesco Mobile

- Business: whose primary offering targets business customers e.g. Gamma

- Roaming: whose offering targets international travellers through roaming agreements with MNOs across multiple markets e.g. Lycamobile

- M2M: specifically supports (embedded) cellular machine-to-machine services e.g. Wireless Logic

Segmentation has allowed providers to focus on niche audiences, with the right blend of services: voice, text and data, and soon M2M with virtual reality possibly on the horizon. It’s a strategy that has paid rich dividends for newcomers like iD Mobile, which grew to 335,000 subscribers in its first year of trading; showing that there’s plenty of life yet in what has been billed as a “saturated” consumer market.

The future of the MVNO

The example of iD Mobile highlights the different points of view in the industry. There are now more mobile handsets than human beings on the planet, and that suggests that mobile is indeed to some degree a saturated market. Chances are, when an MVNO gains a customer, it will not be a new customer, but a win at another operator’s expense.

But our attachment to our mobile phones, led by an increasing number of functions and ever-growing mindshare (we spend hours glued to our small screens!) means that, unlike banks or energy companies, consumers are only too happy to switch suppliers for their mobile contracts. They look for a range of factors: price, device range, OTT services, customer service quality and brand identity.

And as the range of services in our palms grows, the opportunity for MVNOs to discover that crucial point of differentiation also becomes ever clearer. Here are some trends we can expect to see:

- It’s entirely conceivable that onboard technology and OTT services will make it viable to have MVNOs for industry verticals; perhaps bundled up with subscriptions to industry magazines and insurances.

- MVNO’s could differentiate their services further by enabling additional services such as family/business sharing of collective bundles i.e. sharing large data allowances across family members/colleagues based on need

- For media and retail MVNOs, where the brand is as important a driver as revenue, we can expect the MVNO to function more as a marketing machine - read our blog “The 6 reasons retailers should start an MVNO” for examples. A branded app, or location-specific offers, can all serve to increase sales, and we can envisage a circumstance where data and voice minutes become so commoditised that for some customers, their mobile service will be completely free of charge, funded by branded upsells.

- And we can expect the Internet of Things (IoT) to have a major impact across the mobile ecosystem. Today, early adopters are already controlling their heating and home security from apps on their mobile phones. As dynamic data monitoring becomes the norm across all sorts of personal and professional scenarios, MVNOs will no doubt find new segments here, too.

Mobile is a marketplace that enjoys ceaseless innovation. As well as handsets, recent step-changes have included security, onboard advertising, bandwidth availability, content services and application integration – and that barely scratches the surface. This rate of innovation has put handsets in practically every citizen’s pocket and driven exceptional customer demand to remain current. People who wouldn’t dream of buying a car more than once every ten years are more than insistent that they should have the latest handset every year.

Mobile is a marketplace that enjoys ceaseless innovation. As well as handsets, recent step-changes have included security, onboard advertising, bandwidth availability, content services and application integration – and that barely scratches the surface. This rate of innovation has put handsets in practically every citizen’s pocket and driven exceptional customer demand to remain current. People who wouldn’t dream of buying a car more than once every ten years are more than insistent that they should have the latest handset every year.

That is a powerful commercial driver. But riding this wave of innovation is hard. iD Mobile’s explosive growth is a function of its agility – an end-to-end digital offering unencumbered by legacy approaches. MVNO Operators stuck in the outdated pre-pay marketplace or hamstrung by being at the “lighter”, leftward, end of our spectrum - beholden to other businesses’ development schedules – are likely to have a tougher fight to remain relevant. Indeed, several major European MVNOs have recently shuttered, including Sainsbury’s, the UK supermarket brand, and Globe Telecom, from the Philippine telecoms business. Telephony and bandwidth are now just commodities. Successful MVNOs will trade on added value, differentiated services, or brand traction with their subscribers.

[2] 'Telecoms Market Matrix: Western Europe 4Q 2017' William Hare, Analysys Mason, http://www.analysysmason.com/Research/Content/Data-set/TMM-WE//